Managing tax obligations is a common challenge that every business owner must face. Between keeping track of payments and filing forms, it can be difficult to stay organized and keep up with the ever-changing regulations—especially when there are multiple people involved in the company’s finances. But don’t worry! In this blog post, we’ll provide strategies to help you navigate your tax obligations smoother and easier so you can focus on running the most successful version of your business possible.

Understand the different types of taxes your company may be liable for

Managing your company’s taxes is a crucial part of maintaining your business finances. In addition to federal taxes, there are two other types of taxes that you must be aware of and consider when budgeting – state and local taxes. State and local taxes can vary widely depending on where you are located and the type of goods or services your company provides. It is important to understand the different types of taxes you may need to pay and ensure all payments are made in a timely fashion in order to stay compliant. Failure to do this could end up costing your company significantly if fines or penalties are assessed.

Make sure you keep track of all business-related expenses

Managing your business’ finances and tax obligations can seem daunting, but it doesn’t have to be! The key is to make sure you keep track of all business-related expenses. Whether it’s keeping printouts of online purchases or entering every transaction into a spreadsheet, you need an accurate record of everything you spend money on so that you can know the exact amount of taxes you owe. Additionally, make sure to familiarize yourself with what deductions can be taken against your taxes. This could save your business money in the long run if done correctly.

Know when and how to file tax returns

Filing taxes can be a gruelling process, but it is an important step in managing company finances. Knowing when and how to file tax returns on time will keep your business in compliance by preventing any unnecessary penalties or fees. And while the thought of doing your own filing can seem overwhelming, there are plenty of options out there, from hiring a professional tax preparer to making use of online e-filing services. No matter what option you choose, understanding when your taxes are due and taking action accordingly ensures that you’re mitigating potential financial risks for your company.

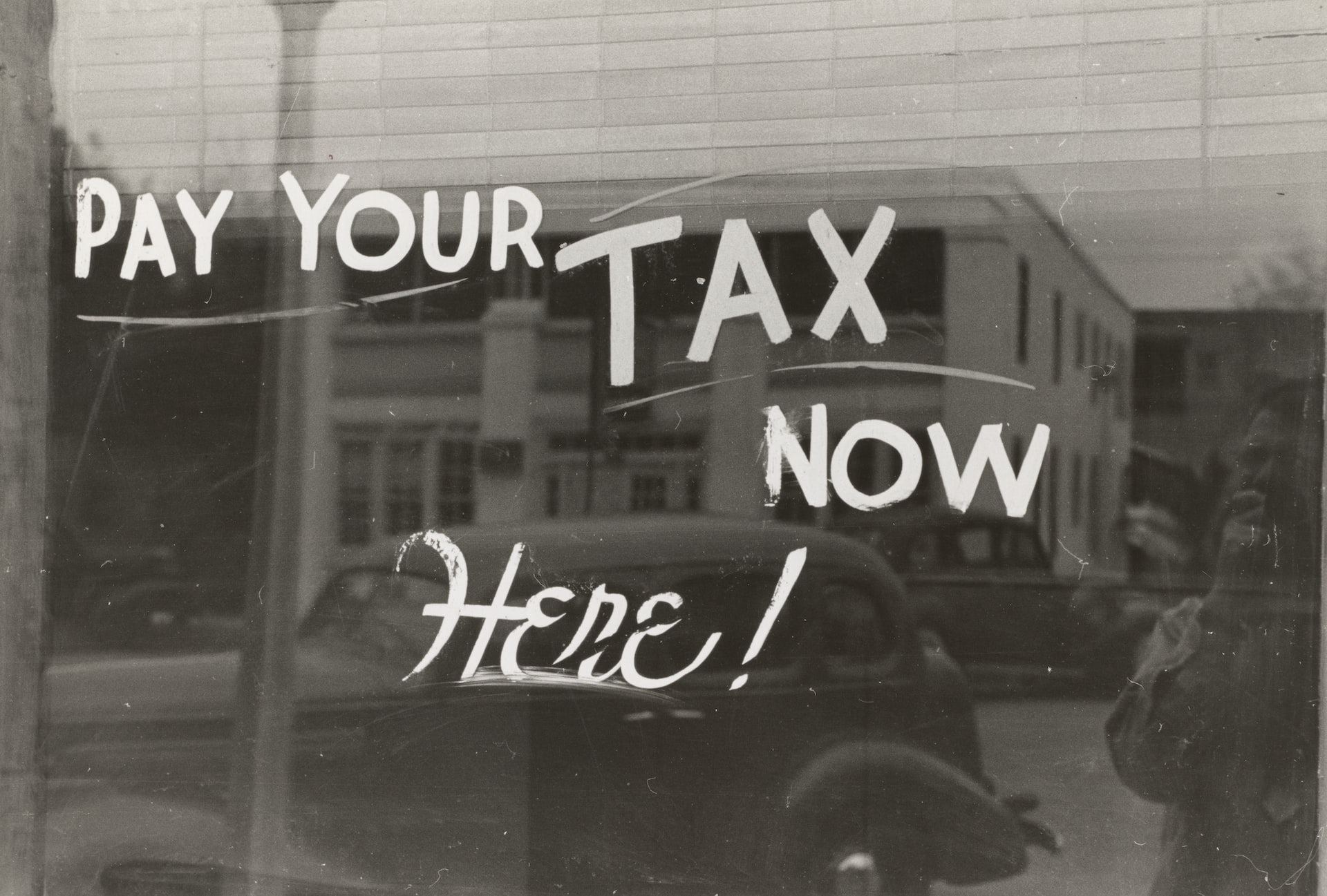

Pay any taxes owed on time

Paying taxes on time is a key component when it comes to managing the financial obligations associated with your company. Not only will you avoid expensive penalties and interest charges, but staying on top of your necessary tax payments also provides peace of mind that you’re properly handling all of your company’s financial commitments. Establishing a timeline for all required payments is helpful in ensuring that any taxes owed are paid before the due date, leaving you to focus on other pressing aspects of running a business.

Seek professional help if needed

If you find yourself struggling with managing your company’s finances and tax obligations, don’t hesitate to seek professional help. A qualified accountant or financial advisor can provide valuable guidance on how to navigate these complex matters. Additionally, if you need legal assistance in dealing with any issues that may arise, visit Prime Lawyers in Parramatta. Their team of experienced lawyers can offer advice and representation to ensure that your company stays compliant with all relevant laws and regulations. Remember, it’s always better to be proactive in addressing financial and legal concerns rather than waiting for them to become bigger problems down the line.

Overall, it is essential to stay up-to-date on your company’s finances and tax obligations. A proactive approach helps keep you ahead of any potential problems, allowing for smoother operations and avoiding unpleasant surprises when the next filing date arises. It can feel intimidating at first but with the right resources and support, small business owners can easily and efficiently manage their taxes. Utilizing help from an accountant and taking advantage of technology solutions can make a huge difference in simplifying your own finances management process. Ultimately, staying organized and having an accurate understanding of your finances is key to managing company tax obligations in a timely manner while keeping more money in your pocket.